About sbaloansHQ

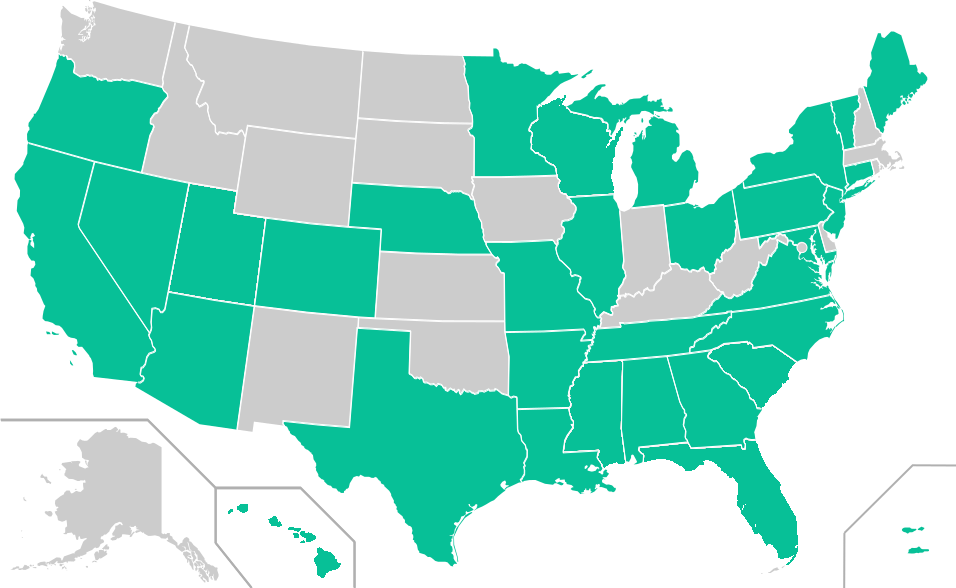

sbaloansHQ is the premier SBA loan brokerage and consulting firm offering loans in Alabama and Nationwide. We specialize in business acquisition financing, commercial real estate purchases, and business working capital. As a certified SBA software and network provider, we connect small business borrowers with SBA-approved lenders nationwide, leveraging over a decade of expertise in the SBA lending ecosystem. Unlike generic business loan marketplaces that overwhelm you with dozens of options, we focus on finding the ONE lender that will actually execute your transaction. Our extensive network of SBA lenders actively seeks borrowers just like you, and our expertise in SBA loans is what sets us apart from the competition.

$1.2MM

98%

Elevate your business

Why choose sbaloansHQ.

Certified SBA Expertise: As an SBA focused group, we're authorized to work directly with SBA systems and approved lenders on your behalf, streamlining your loan process and navigating complex regulations.

Business Acquisition Specialists: Business acquisitions represent over 95% of our portfolio. We understand the unique challenges of buying existing businesses, from structuring deals to minimize down payments to coordinating between all parties.

Proven Results:

- $1.2MM+ average loan amount

- 98% approval rate (after initial pre-approval stage)

- Over 500 clients helped to date

- 13+ years of SBA lending experience

Read about some of our past client success stories

We pride ourselves on being the most customer-focused firm for prospective small business borrowers. Whether you know exactly what you need, or you're just exploring options, reach out and experience the difference for yourself.

- Experienced & ReliableExperienced & Reliable

- Small Business FocusedSmall Business Focused

Industries We Serve

Here are just a few examples of some of the industries we typically do business in:

Hotels

Assisted Living

Gas Stations

Restaurants

Real Estate

E-commerce

Automotive

Trade Business

Our SBA loan expertise spans multiple sectors, with particular strength in commercial real estate business acquisitions:

Hospitality & Food Service: Hotels, motels, restaurants, entertainment venues

Healthcare & Senior Care: Assisted living facilities, medical practices, dental clinics, physical therapy centers

Automotive & Transportation: Auto dealerships, gas stations, service stations, automotive repair shops

Real Estate & Construction: Commercial real estate acquisitions, construction companies, property management

E-commerce & Technology: Online retail businesses, software companies, digital marketing agencies

Trade & Manufacturing: HVAC companies, electrical contractors, plumbing businesses, manufacturing operations

And Many More: We've successfully closed loans across virtually every industry that qualifies for SBA financing.

Our team

Zachary Renta

President

Zachary brings a unique perspective to SBA lending with over 10 years of experience on both sides of the lending equation. His diverse background provides unmatched insight into what makes deals work. Restaurant Industry Foundation: Started his entrepreneurial journey in restaurants, gaining firsthand understanding of small business operations, cash flow management, and growth challenges. Heavy Equipment Experience: Years working on heavy equipment provided practical experience with asset-intensive businesses and equipment financing needs. Lender Service Provider Expertise: Spent over 10 years as an LSP helping community and regional banks navigate SBA lending programs, developing deep expertise in SBA regulations, underwriting standards, and lender requirements. Borrower-Side Specialization: Now applies his extensive lender-side knowledge exclusively to benefit small business owners seeking optimal financing solutions. This dual perspective - understanding both lender requirements and borrower needs - allows Zachary to structure deals that work for everyone involved. When he's not closing loans, you'll find him with his wife and kids, mountain biking, climbing, or thinking about his next great meal.

Our Proven Process

What makes us different

1. Strategic Consultation: We start with a comprehensive analysis of your financing needs and SBA eligibility, focusing on structuring your deal for optimal terms and minimal down payment.

2. Lender Matching: Instead of shotgun approaches, we leverage our network to identify the ONE lender best suited for your specific transaction based on industry, location, and loan characteristics.

3. Complete Management: Our strict SBA focus allows us to handle everything from document collection and SBA form completion to closing coordination and real-time status updates.

4. Technology Advantage: Direct access to sbaloansHQ custom built SBA loan tracking and document management system, being used by SBA loan brokers and SBA Lenders alike. This means faster processing and real-time updates throughout your loan process.

Hear what our clients have to say about working with us

Ready to Get Started?

Contact SBA Loans HQ today for a no-obligation consultation. Our expertise in SBA lending and extensive lender network give you the best opportunity to secure optimal financing terms for your business goals.

What sets us apart:

- Zero application fees

- Transparent pricing

- Expert guidance throughout the process

- Direct access to decision-makers

- Real-time status updates

Whether you're looking to acquire an existing business, purchase commercial real estate, or secure working capital for expansion, we have the experience and lender relationships to make it happen.

Frequently asked questions

SBA loans are all we know! Many resources are available to you to find the funding that best suits your needs. But with sbaloansHQ you aren't just getting thrown into some algorithm, you're dealing with live SBA experts that know exactly how to get your project funded.

Absolutely! Many banks offer SBA lending services. The problem most people run into with dealing directly with their bank is time. Firstly, some banks just are not set up to deal with SBA loans efficiently. Second, if there was another bank our there that could offer you better terms or get your deal done more quickly, wouldn't you want to know?

In some cases, yes! One of the most prominent benefits of an SBA loan versus a conventional loan is the out of pocket costs. Existing businesses can typically borrow funds for real estate purchases, expansions, equipment, or working capital with little to no money out of pocket. We can also finance a partner buyout situation in most cases with no down payment. If you are just starting out or buying an existing business, we'll typically look for 5% to 10% of the project costs to be contributed by the buyer.

We’ve closed acquisition loans as fast as 30 days from the initial loan proposal, while others have taken several months. The average time is 10 weeks. In most all cases, the buyer and seller get to dictate the closing date. As a buyer you’ll want to work plenty of time into the contract to do your own due diligence, while we work in the background.

These projects are some of our favorites. We work with lenders who view your existing time spent in the business as your equity, and don't require you as the buyer to contribute any cash down payment. Unfortunately, SBA still needs a minimum of 5% of project costs to come from your side. We can help you figure that piece out as well. Between the seller and the SBA loan, we can finance the purchase price, working capital, closing costs, and anything else that my be needed into the project.

Compared to a conventional business loan, SBA loans typically offer more favorable terms. The exact interest rate and loan term are chosen by the lender, but fall under SBA's guidelines which conventional loans don't have to follow.

For sure! Many times, when you buy a business there are not enough hard assets (think equipment/real estate) to secure a conventional loan. SBA loans provide a government backing, and allow lenders to make loans to businesses that aren't always fully collateralized.

We offer a tiered approach to our pricing, which varies based on how you think we can serve you best. There aren’t any application fees, so you always know exactly what you’re signing up for.

Yes! New SBA rules and regulations that came out in 2023 allow for the "partial buyout" of a company. Meaning, you can get a loan to buy stock from a current owner, while they retain some ownership themselves. If it is structured correctly, you don't need any down payment. The seller will need to agree to "co-sign" with you for 2 years, but often this isn't an issue as they still get paid up front and then can transition slowly into retirement.

This is the answer

In most cases, when the loan amount is over $350,000, the lender is required to put a lien on personal real estate that has 25% or greater equity. Their lien would be behind your current mortgage/deed of trust.